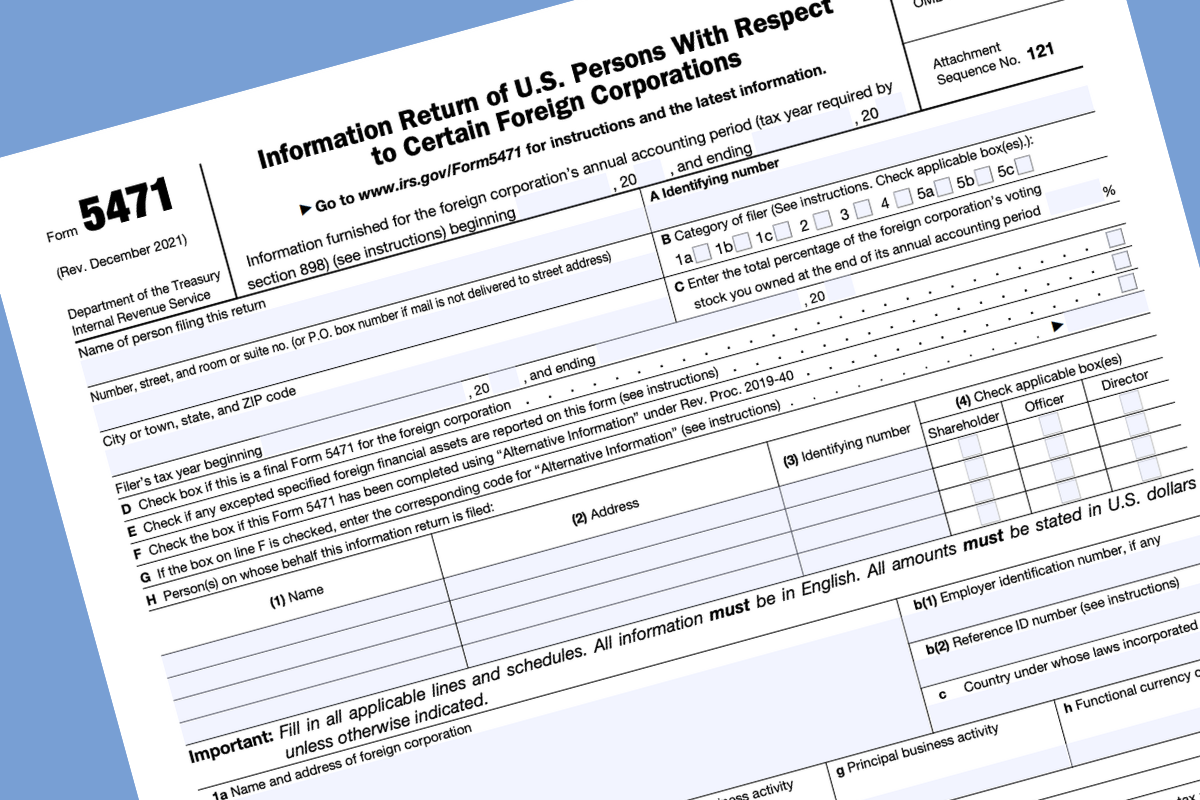

What Is IRS Form 5471?

IRS Form 5471 is a complex tax reporting requirement used by certain U.S. citizens and residents who are officers, directors, or shareholders in specific foreign corporations. The form serves as an information return and is required to meet the filing obligations under Internal Revenue Code sections 6038 and 6046.

Failing to file Form 5471 correctly—or on time—can result in hefty penalties of $10,000 or more per year per form. It is one of the most misunderstood and overlooked filing obligations for international tax compliance.

Walter Ludlow, CPA is a trusted tax expert who specializes in IRS Form 5471 and other international tax reporting for U.S. individuals and corporations with foreign interests.